- News & InsightsBeware the allure of dividends

Beware the allure of dividends

08 Nov, 2018

Kyle Hulett, Sygnia Head of Asset Allocation

High dividend funds are often touted as a one-stop solution for investors. They are sold with the promise of providing the growth prospects of equities and tax-efficient income relative to bonds and properties, delivering these benefits with lower risk due to the quality bias of dividend-paying stocks. Unfortunately, this is not all true.

High dividend funds are often touted as a one-stop solution for investors. They are sold with the promise of providing the growth prospects of equities and tax-efficient income relative to bonds and properties, delivering these benefits with lower risk due to the quality bias of dividend-paying stocks. Unfortunately, this is not all true.

Income or growth

The choice between income-producing investments and inflation-beating growth investments should be relatively simple based on one’s needs. If you need to save for retirement and require long-term growth that beats inflation, you choose real assets such as equities. If you require income from your savings to support your expenses, move a portion of your savings into income-producing assets such as cash, bonds or property. However, as discretionary investments are subject to tax the net return of the assets must be considered as tax complicates decisions significantly.

Dividends are inefficient income

Under the South African tax regime, it is inefficient for companies to pay dividends, as investors are taxed at 20%, which is paid immediately. If the company retained those earnings, the cash would generate value in the company, which would eventually flow through to the investor via capital growth and taxed at a lower rate. More importantly, they would only pay the tax in the future when the cash was required, thereby removing the reinvestment risk that arises when more dividends are paid than required.

However, companies do pay dividends. As a result, many investors select high dividend yield stocks as proxies for bonds, meaning they can receive income that only attracts 20% tax, rather than invest in fixed-interest funds, money market funds, or property. These all attract tax at the marginal rate of up to 45% on the interest or rental income.

Equity-like growth before costs

To assess dividend portfolios, we analyse two listed dividend-focused indices – the JSE/FTSE Dividend Plus Index and the S&P South Africa Dividend Aristocrats Index – and compare the performance of these two indices to the JSE/FTSE All Share Index.

Over the last five years, both dividend indices have shown returns similar to that of the overall index. However, the costs of replicating the indices are very different. The Dividend Plus Index has far higher trading costs than the JSE All Share Index, which averages an annual turnover of 6% of the portfolio, while the Dividend Plus Index has nearly 80% turnover. This increased turnover leads to higher brokerage costs, stamp duty and bid/offer spreads, easily accumulating to more than an additional one percent in costs to the investor per year – a substantial impact on any return.

Dividend funds have experienced higher risk

One of the main reasons that companies pay dividends is the signalling effect. In today’s world, after numerous corporate scandals such as Steinhoff, many investors do not trust management or auditors. Earnings can be “smoothed”, whereas dividends are a tangible return to investors. This means that the regular payment of dividends provides investors with an apparent assurance that the business is credible, and that management are performing well. Consequently, high dividends are often seen as a sign of a safe, quality business with high cash flows - a blue-chip investment.

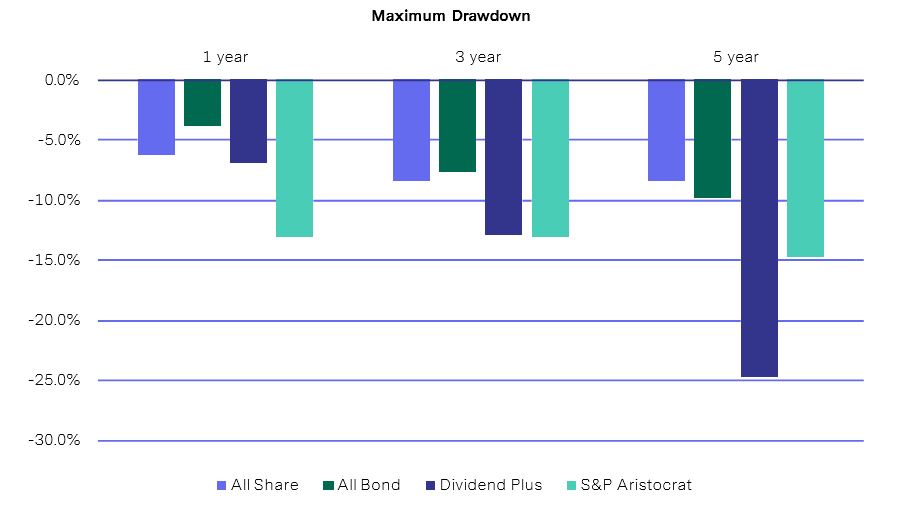

This is not always the case, though, and the misconception is that high dividend stocks are bond proxies with lower risk. High dividend stocks do not have lower volatility or lower drawdowns than the market. Looking at the returns of the FTSE/JSE Africa Dividend Plus Index and the S&P South Africa Dividend Aristocrat Index over one year, three years and five years, the most striking observation is that the dividend indices have the highest volatility and worst drawdown over all periods.

Over five years, the Dividend Plus Index had a drawdown of 25%, compared to the All Share Index drawdown of only 8% (see maximum drawdown chart). This return profile is visibly more unstable than a fixed interest asset like a government bond, which has the lowest drawdown.

Focus on total after-tax returns

Investors must look at total returns after tax on their investments, which means that even those looking for tax efficient income should invest in the broad index and choose to sell shares as and when they need, rather than receive dividends. Dividend yield funds have much higher volatility, are more expensive, and thus are not suitable as the core component of a retirement savings plan. If you want true lower volatility stick to cash, income or bond portfolios.

Holistic view of investments

It is also important to consider your savings in a complete manner and compartmentalise various needs such as retirement, education and holiday expenses. By looking at your combined savings you can ensure that it is invested in a tax efficient manner through selecting the correct assets using the most efficient product.

For example, if you require income assets like property, or bonds with high tax rates then allocate these to your tax-free savings accounts or retirement annuity and keep lower tax attracting assets like equities in discretionary vehicles such as unit trusts.

In conclusion

Whilst high dividend funds are indeed valuable in some instances, it is wise to consider your overall investment goals. Asset allocation can be affected by the constantly changing tax regime, making it vital to have the appropriate mix of income and growth assets safely invested in a smart and appropriate product wrapper, ensuring the best tax and expense returns.

Share

- Facebook

- Twitter

- LinkedIn

- Email