The Ultimate Guide to Tax Free Savings Accounts in South Africa

One of the smartest financial choices you can make is to open a Tax Free Savings Account.

This guide is packed with all the information you need to understand how these accounts work and how to choose the right one for yourself. Let’s get started!

Contents

1. What is a Tax Free Savings Account (TFSA)?

A Tax Free Savings Account (TFSA) is a savings and investment option that lets you enjoy tax-free returns on your hard-earned money. It was introduced by the South African government in 2015 by virtue of S12T of the Income Tax Act to encourage people to save and offer them tax benefits. It’s a fantastic opportunity to plan for your future while keeping more of your money in your own pocket.

2. Advantages of a TFSA

Tax-free growth: One of the best things about a TFSA is that any money your investments earn (like capital gains, dividends or interest) is completely tax-free! That means your savings can grow faster over time, because you won’t pay any taxes on those earnings. It’s like giving your money an extra boost!

Easy withdrawals: Unlike other investment accounts, you can take money out of your TFSA whenever you need it, for any reason, without worrying about taxes or penalties. So whether you’re planning a dream vacation, dealing with unexpected expenses or saving for education or retirement, a TFSA gives you the flexibility to access your funds without any hassle.

Contribution flexibility: With a TFSA, you can contribute up to R36 000 per year tax-free, and up to R500 000 in your lifetime (these limits are set by the South African government). You are free to contribute as much or as little as you want within these limits – it’s all about what works best for you and your financial goals.

Investment options: TFSAs offer a wide range of investment choices, including unit trusts and exchange traded funds (ETFs). This gives you the power to customise your investment portfolio based on your risk tolerance, time horizon and financial goals. You’re in control, and you can choose investments that align with your needs and aspirations. So, whether you’re a savvy investor or just starting your savings journey, a TFSA offers you peace of mind and plenty of benefits. It’s a smart way to make your money work harder for you while enjoying the freedom to use your funds when you need them most.

3. Limits of a TFSA

TFSAs are a fantastic way to secure your future, but it is easy to lose track of how much you have contributed. If you exceed the TFSA contribution limits set by the South African government (R36 000 per person per annum up to a maximum lifetime contribution of R500 000), a hefty 40% tax will be levied on the excess amount.

For example:

If you invest R18 000 in one of your TFSAs and R20 000 in another TFSA in the same tax year, you will have contributed R2 000 over the annual limit. You will thus have to pay 40% tax (R800) on the extra R2 000.

4. TFSA investment options

The world of investment options in a TFSA is vast, and many factors will dictate how you invest, including your risk tolerance and investment horizon. Here is an excellent article that drills down into all the factors you should consider when selecting investments for your TFSA.

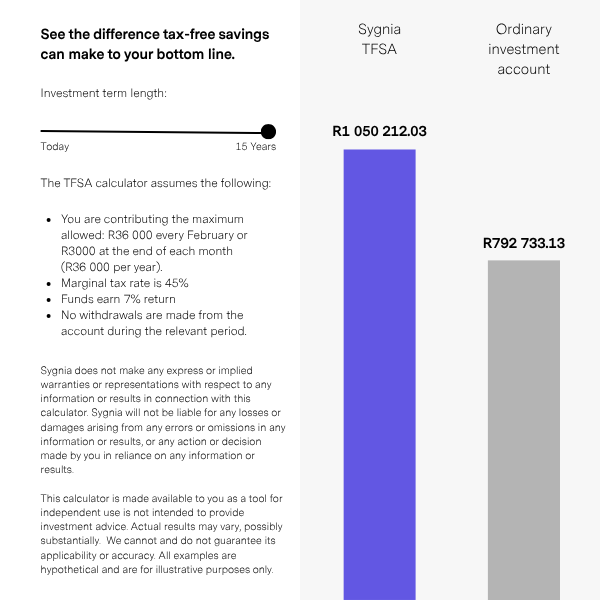

5. TFSA calculator

6. Opening a TFSA

Rules differ from provider to provider, but to open a Sygnia TFSA you will need:

- A copy of your SA barcoded ID or valid passport

- Proof of residential address less than three months old

- Proof of bank details less than three months old

- Proof of deposit/transfer into the relevant Sygnia bank account

- Signed application form

The process is relatively easy, particularly if you do it online. Any South African or South African resident can open a TFSA. While many institutions offer TFSAs, look for one that charges low fees, provides an exciting array of funds and has excellent client service.

7. Moving your TFSA from another institution.

Switching your TFSA to Sygnia? You have the freedom to do so, and Sygnia is here to make it a breeze. Best of all, we won’t charge you any fees for transferring your TFSA! We’re committed to providing you with a seamless experience throughout the process.

Exclusive video series

Sygnia Tax Free Savings Accounts Explained

Frequently asked questions

Can I set up an education fund with a TFSA?

Excellent idea! For example, the Sygnia Stargazer Fund is designed for just that, offering three simple portfolios and a unique glide-path design to control your child’s portfolio risk.

How much flexibility does a TFSA offer?

Loads! You can open multiple accounts, access your cash whenever you like and choose from diverse investments like ETFs and unit trusts. But remember the total amount you contribute to your TFSAs cannot be more than your available TFSA contribution available for that year and your lifetime.

Are there any downsides to a TFSA?

Well, unlike protected retirement funds, creditors can seize TFSA funds. Also, unintentional over-contributions can lead to tax penalties. So it’s crucial to know the rules and track your contributions. You can withdraw money from your TFSA whenever you like, but keep in mind, any money you take out can’t be put back in. It’s because any reinvestment is seen as a new investment and it’ll count towards your yearly and lifetime limits. So let’s say you take out R100 000 – this will shrink your lifetime limit down to R400 000. Any money you put in beyond this limit is going to be taxed.

Who can open a TFSA?

All South African residents are eligible to open a TFSA, including parents/guardians for their children.

What happens if I don't invest the full R36,000 annual limit?

If you choose not to invest the full R36,000 annual limit, it’s important to remember that any unused portion of the limit cannot be rolled over to the next year. For instance, let’s say you only invest R25,000 during the year, leaving R11,000 unused. Unfortunately, that remaining R11,000 cannot be carried forward, and it will be forfeited. So, it’s crucial to utilise your full annual limit to maximise its benefits.

Can I share a TFSA with my spouse/partner?

Sorry, TFSAs can only be opened in the name of one individual.

Can I open a TFSA for my kids?

Absolutely! Just remember the contributions count towards their annual and lifetime tax-free savings limits and any withdrawals have to be paid into a bank account in the child’s name.

Can I open a TFSA for a trust or company?

No, TFSAs in South Africa are only for individuals.

Is there a fee to open a Sygnia TFSA?

We don’t charge any fees to open an account. However, there are various fees associated with administering the Tax Free Savings Account. Those are disclosed when you open the account as part of your application process.

What do I need for a Sygnia TFSA?

Just a valid South African ID (or passport if you’re a foreign national), proof of residence and banking details (both less than three months old), and, if applicable, your income tax number. Also, be ready to fill out our application forms and invest at least R500 per month.

Can I stop contributing to a Sygnia TFSA if I'm running low on funds?

We totally understand that life can throw financial curveballs. The great news is that with our TFSA, you can pause and resume contributions whenever you need to, without any pesky penalties.

Is there a minimum income for a TFSA?

No, but be prepared for any minimum monthly payments set by the provider. For Sygnia, it’s R500 per month via debit order.

Do I need regular income for a TFSA?

No, just meet the minimum monthly contribution stipulated by the provider.

How much can I invest tax-free in a TFSA?

Currently, it’s R36 000 per person per annum, with a lifetime limit of R500 000.

Can I have multiple TFSAs?

Yes, but be sure to keep your total annual contributions within the R36 000 annual limit.

Can I invest offshore with my TFSA?

Not directly, but you can invest via rand-denominated offshore investments. Your capital will be invested overseas but will return to SA and be converted to rands when you redeem your investment.

How much should I contribute to my TFSA?

Try to hit the annual limit of R36 000. If you haven’t got there before the end of the tax year, consider a lump sum payment to maximise your annual tax-free savings.

How can I pay into my TFSA?

Top providers will let you set up a monthly debit order or make direct deposits into your account.

What happens if I exceed the annual tax-free contribution allowance?

Be ready for a 40% tax on any amount over R36 000.

When can I withdraw from my TFSA?

Anytime you want – it’s your money!

How can I keep an eye on my annual tax-free contributions so I don’t lose track of the limit?

Any stellar TFSA service provider will send you a quarterly rundown of your contributions. The cream of the crop will have a user-friendly online platform so that you can check your contributions whenever you want!

Can I make withdrawals from my TFSA whenever I want?

The good news is that your tax-free investment (both the capital and income growth) is always at your disposal. You can dip into your TFSA whenever you want!

Are TFSA withdrawals subject to income tax?

No, but keep in mind that they still count towards your lifetime tax-free contribution limit.

Wondering if TFSAs are better for short-term savings or for retirement?

They’re flexible! You can use a TFSA for short or long-term savings, but the best way to fully reap tax-free benefits and compound interest is to go long term.

Debating if a TFSA is a better retirement savings plan than a retirement annuity?

It’s not about better or worse, really. A TFSA is a valuable tool for long-term retirement savings; due to its tax efficiency, it works beautifully alongside pre-retirement savings provisions. Still got some questions, or just need a bit more clarity? No worries! Have a chat with a financial advisor. They’re like a personal GPS for your finances, ready to guide you through these decisions and tailor a retirement plan that fits just right for you.

Is it possible to retire with only a TFSA?

It’s unlikely that the lifetime tax-free investment limit of R500 000 will carry you through retirement, even with high growth. Ideally, your TFSA should complement other investment products in your retirement savings plan.

Want to check if a TFSA service provider is legitimate?

First, check that the provider is authorised to provide a Tax Free Savings Account. National Treasury and SARS have stated that only specific institutions can provide them to South African consumers.

What happens to your TFSA if you pass away?

Your TFSA will be distributed in line with your will. If there is no will, the laws of intestate succession in South Africa apply. The executor of your estate will close the TFSA and distribute the funds accordingly.