Sygnia Securities

Start trading with Sygnia Securities.

Who we serve.

For over ten years, Sygnia Securities has set the standard for institutional trading on the JSE. Now, we’re bringing that same expertise directly to private investors.

James M

“I have been trading with Sygnia Securities for many years. Their personalised service and professionalism is what differentiates them from other brokers and makes them my trading partner of choice.”

Ready to apply?

Here is what you need:

Certified Copy of ID/Valid Passport

Proof of Banking Details – Bank Statement/Bank Confirmation Letter, not older than 3 months

Proof of Income Tax number as reflected on an official SARS/Relevant Tax Authority document

Proof of Residential Address, not older than 3 months

Securities – General

What is a stockbroking account?

A stockbroking account is an investment account that allows investors to buy and sell JSE listed shares through a broker.

How do I apply for a stockbroking account?

You can use the following link to apply for an account: https://securities.sygnia.co.za

What types of stockbroking accounts are available?

Normal Stock broking account where you can trade in all JSE listed securities

Exchange Traded Product account which is limited to low-cost passive investments. (ETF’s only)

How much money do I need to start investing?

Currently there is no minimum it depends on how much you have to invest.

Can I open a stockbroking account for my child?

Yes.

Can I open a stockbroking account for a company or trust?

Yes.

What FICA documents are required?

As per the updated required documentation here.

What are the fees involved?

For reference, trading and custody fees are detailed below, along with information regarding our optional online platform.

| Fees for equity trading account | |

| Monthly safe custody fee | R60pm excl. VAT |

| Brokerage rate | 0.50% excl. VAT, subject to a minimum of R150 per transaction |

| Turn on interest earned on cash balance | 0.40% p.a excl. VAT |

| Portfolio transfer to another broker | R85-00 excl. VAT per counter (no charge if a portfolio is being transferred from another broker) |

| Fees for ETFs | |

| Brokerage rate | 0.10% excl. VAT, no minimum fee |

| Turn on interest earned on cash balance | 0.40% p.a excl. VAT |

| Portfolio transfer to another broker | R85-00 excl. VAT per counter (no charge if a portfolio is being transferred from another broker) |

| Statutory fees | |

| Strate settlement fee | 0.006018% of transaction value excl. VAT (minimum R6.99, maximum R129.27) |

| FSCA investor protection levy | 0.00031% of transaction value excl. VAT |

| Securities transfer tax (STT) | 0.25% of transaction value payable on purchases only (ETFs are exempt from STT) |

| Turn on interest earned on cash balance to JSE | 0.20% p.a incl. VAT |

Is it safe to invest through a stockbroker?

Yes. We are highly regulated under the Financial Markets Act (FMA) and clients’ investments are protected by being held in JSE Trustees (cash) and the brokers nominee company (shares).

Can I lose money when investing?

Yes you can. Market prices fluctuate depending on various factors including market conditions, liquidity etc.

What taxes apply to share trading?

- Capital Gains Tax / Income Tax may be payable when disposing of shares.

- Dividends Tax is payable and deducted from the dividend when paid to your account unless you qualify for an exemption or reduction.

- Securities transfer tax of 0.25% on the purchase of shares. (ETF’s are exempt from STT)

Do I receive interest on my funds?

Yes. Interest is accrued daily and paid monthly into your Sygnia Securities Account.

How do I deposit funds into my Sygnia Securities Account?

Once your account is open, we will send you an email with all pertinent information including the bank account details which you can use to do an EFT transfer.

Can I fund my account with a monthly debit order?

No, unfortunately Sygnia Securities do not have this facility.

How can I with draw money from my Sygnia Securities Account?

You can email setttlement@sec.sygnia.co.za before 12pm if you would like to request a funds transfer.

How long will it take for the funds to reflect in my account?

Funds can take up to 48 hours to reflect in your account.

How do I access my account?

You can login to your account using the same link that you used to open your account as long as you have registered your account once opened. https://securities.sygnia.co.za

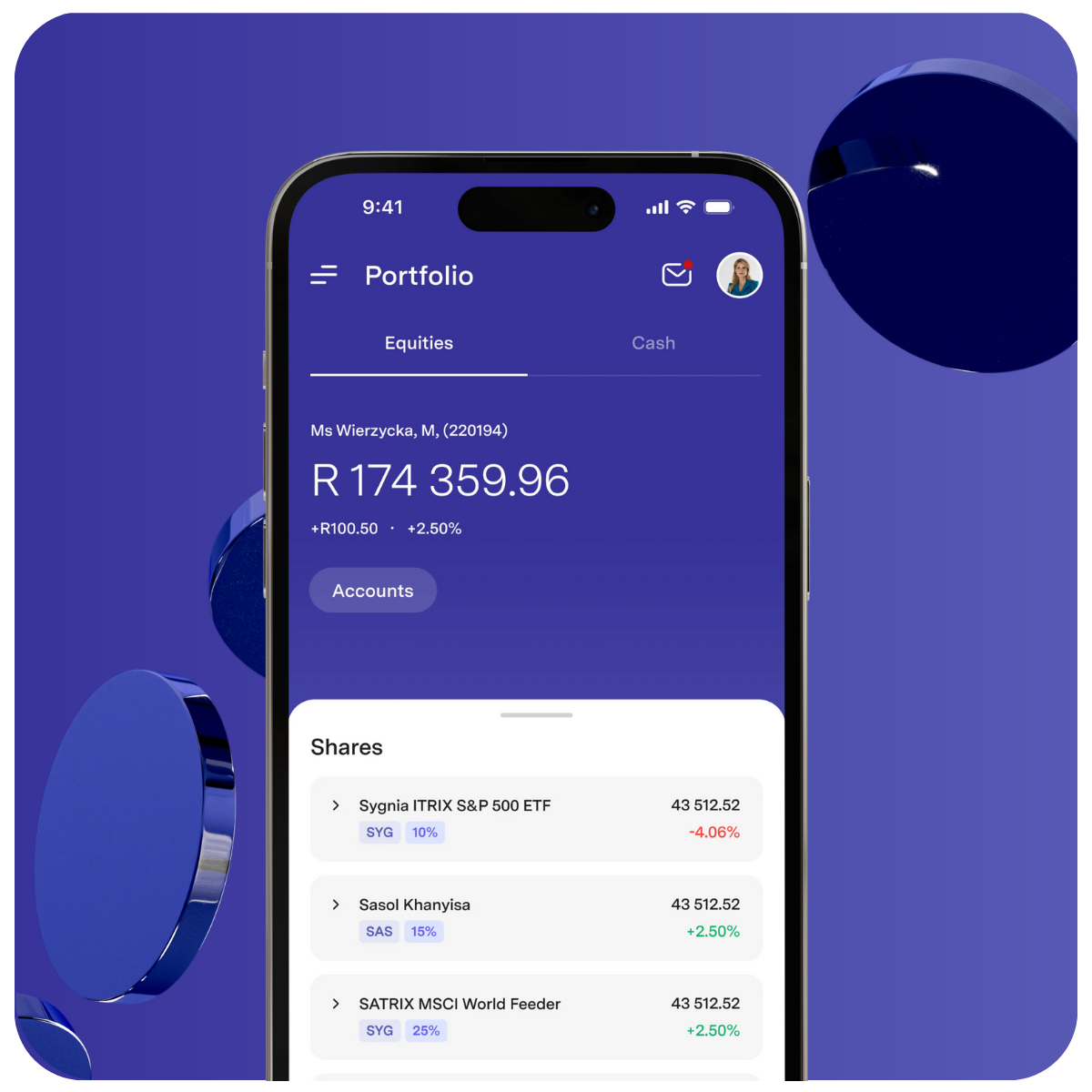

What information can I get when I access my account?

You are able to access the following information: Portfolio view, Transaction history, Brokers notes, Monthly Statements, Tax documents and Weekly Market Report.

Can I trade in offshore shares?

No, unfortunately we are only authorised to trade in JSE listed shares.

Can you advise me on what shares to buy/sell?

No, we are a non-discretionary Broker and as such are not authorized to provide advice

Who do I contact place trades on my account?

You can call or email the dealing desk using the following information: dealingdesk@sec.sygmia.co.za or (010) 595-0559/0561/0563 or you can place a trade instruction via our online platform once your account is registered.

When are funds available from the sale of shares?

Sales are settled on a T + 3 basis (Trade date + 3 Business days) after which funds will then be available on your account.

How can I invest in a tax-free savings account?

If you would like to invest in a tax-free savings account, please email admin@sfs.sygnia.co.za or apply online via the Sygnia website.

Exchange Traded Funds (ETFs)

What is the legal structure of Sygnia Itrix ETFs?

Sygnia Itrix ETFs are portfolios of the Sygnia Itrix Collective Investment Scheme registered under the Collective Investment Schemes Control Act 45 of 2002.

What are the risks of investing in Sygnia Itrix ETFs?

Investing in Sygnia Itrix ETFs involves a number of risks, such as general market risks, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

The value of an investment in a Sygnia Itrix ETF may increase as well as decrease, and past performance is not a guide to future performance. Investors should note:

- Sygnia Itrix ETFs are not capital protected; investors may not get back the amount invested.

- Sygnia Itrix ETFs may trade in limited markets, which may impact bid/offer spreads.

- Sygnia Itrix ETFs may be unable to precisely replicate the performance of an index.

- Investors’ income is not fixed and may fluctuate.

- The value of any investment involving exposure to foreign currencies can be affected by exchange rate movements.

- Tax treatment of the Sygnia Itrix ETFs depends on the individual circumstances of each investor. Investors should consult their tax advisor for more information.

For further information regarding risk factors, please refer to the risk factors section of the listing particulars.

How do I process an additional investment into my Sygnia Alchemy platform investment?

Submit an additional investment instruction online via Alchemy platform eTransact or complete and submit an Additional Investments Form (available under Application Forms) via email or fax. For lump sum additional investments, you will need to deposit the amount into the nominee’s account, details of which appear on the application form, and submit the confirmation of payment via fax or email.

What fees are associated with the Sygnia Alchemy platform?

Transaction costs

A stockbroker fee of 0.10% excl. VAT is charged per transaction, with no minimum fee payable. Statutory charges relating to the Investor Protection Levy of 0.0002% excl. VAT and a nominal Strate settlement fee are charged per transaction.

Investment management fees

These vary widely across the Sygnia Alchemy ETF fund range. For a detailed breakdown of ETF-specific fees, please refer to the Sygnia Alchemy ETF and ETN Fund Summary or the Sygnia Itrix page.

Financial advisor fees

If you use a financial advisor, the fees will be negotiated independently between you and your advisor.

How long does it take to process a new application?

All completed application forms (accompanied by the correct FICA documentation) received before 14:00 will be processed on the following day. Applications received after 14:00 will be processed on the following day or the day thereafter.

How can I make a lump sum investment?

The minimum amount for an initial lump sum investment is R1 000, with a minimum of R250 per ETF selected. The lump sum amount must be deposited into the nominee’s account, which appears on the relevant application form.

What is the required FICA documentation for investment via the Sygnia Alchemy platform?

Please see the relevant application forms for a list of required FICA documents.

Please see the relevant application forms for a list of required FICA documents.

You can get an application form on the How to invest page. Please note that the relevant FICA documentation must be supplied with your application. Should you make a lump sum investment, the funds must be deposited into the nominee’s bank account (as indicated on the relevant application form). Please submit the application form with the proof of deposit and all FICA documentation (refer to FICA checklist on the form) via fax or email.

Should you invest via a monthly debit order, please submit the completed application form and all required FICA documentation. It is important that you read and understand the terms and conditions, as the declaration you sign on the application form states that you have read and understood them.

Are Sygnia Itrix ETFs subject to securities transfer tax (STT)?

Sygnia Itrix ETFs are not subject to STT.

How do I track the performance of my investment?

The Sygnia website includes downloadable fact sheets and prices since launch that allow you to track your investment. If you would like to receive communication from the Sygnia Itrix ETF team about fund performance, new funds and/or market-related updates, please email us at sygitrix@sygnia.co.za to be included on our mailing list.

Do I need Reserve Bank clearance to invest in Sygnia Itrix ETFs?

Investments in Sygnia Itrix ETFs by South African individuals, corporate entities (companies, close corporations, etc.), trusts, partnerships, investment clubs or stokvels are no longer considered a foreign investment requiring approval by the Exchange Control Department. It is therefore possible to invest in Sygnia Itrix ETFs without limits and without administrative difficulties.

Long-term insurers, investment managers, pension funds and collective investment schemes seeking quick, easy and cost-effective offshore exposure can invest in Sygnia Itrix ETFs by using their offshore allowance.

Do Sygnia Itrix ETFs pay dividends?

A distribution payment is made semi-annually.

What makes Sygnia Itrix ETFs any different from an offshore unit trust?

Sygnia Itrix ETFs differ from offshore unit trusts in that ETF costs are generally lower as a result of passive management strategies, and because shares can be traded at any time during the trading day. When moving money offshore using your foreign exchange allowance and depositing it in an offshore-based (rather than South African) unit trust, please note that Sygnia Itrix ETFs have access to preferential institutional foreign exchange rates rather than retail ones. This currency exchange cost can be a large initial cost when transferring money offshore.

What are the tax implications of Sygnia Itrix ETFs?

Investments in Sygnia Itrix ETFs are subject to capital gains tax (CGT). Foreign dividends are considered income and will therefore be subject to income tax. Exemptions may apply, but please consult your tax consultant for clarity.

My financial advisor says they are unable to buy or sell Sygnia Itrix ETFs funds for me. What should I do?

If your financial advisor or stockbroker is unable to purchase Sygnia Itrix ETFs on your behalf, please ask them to contact the Sygnia Client Service Centre on 0860 794 642 (0860 SYGNIA) for assistance with the process. You can also invest directly in Sygnia Itrix ETFs by contacting the Sygnia Client Service Centre, but please be aware that we are cannot provide financial advice.

What is the currency exposure when buying Sygnia Itrix ETFs?

The performance of Sygnia Itrix ETFs is based on a combination of currency and index performance. For example, the performance of the Sygnia Itrix FTSE 100 ETF is based on the performance of the GBP/ZAR exchange rate as well as the performance of the FTSE 100 Index. A positive performance in currency reflects a depreciation of ZAR against base currency, and vice versa.

How do I trade large volumes of Sygnia Itrix ETFs?

To facilitate small trade sizes, the market maker will always show an on-screen price for small volumes. Due to the efficiencies involved, in the financial market you get a better price the larger your trade size – this is the case with Sygnia Itrix ETFs. If you would like to trade in sizes larger than the on-screen bid-offer, please contact the Market Making Desk directly on +27 11 775 7014/7812.

How is the net asset value (NAV) of Sygnia Itrix ETFs calculated?

Prices are calculated on a NAV basis, which is the total market value of all assets in the portfolio – including any income accruals and less any permissible deductions from the portfolio – divided by the number of units in issue.

Due to intraday price movements in the value of the constituent basket of securities, the price at which ETFs trade on an exchange may differ from the NAV price published at the close of the trading day.

Can I move my Sygnia Itrix ETF investment into another offshore account?

An investment in Sygnia Itrix ETFs is deemed a local investment for South African investors, but while it gives you exposure to offshore stock markets, it is not freely transferable in terms of existing exchange control policy. The sale proceeds of any such investment must always be credited to a ZAR account, which may then be used in terms of the exchange control rules currently in force.

How do I process a Central Securities Depository Participant (CSDP) transfer of my investment?

Complete and submit a CSDP transfer form via email or fax. Once the form has been submitted, our administration department will liaise with the institution you requested your holdings to be transferred to. Upon confirmation we will proceed with the transfer. Please note there is a 32-business-day holding period on ETF and ETN securities bought with the most recent debit order.

When will my additional investment be processed?

If your additional investment form and funds are received before 14:00, your application will be processed the following day. If we receive them after 14:00, it will be processed on the following day or the day thereafter (as per our terms and conditions).

How do I sell a Sygnia Itrix ETF?

Simply instruct your broker, financial advisor or platform provider to sell your specified number of shares or contact Sygnia Itrix directly. Any trades in Sygnia Itrix ETFs will be settled through STRATE. There are no product exit fees for Sygnia Itrix ETFs. Your broker may, however, charge a fee for executing the sale on your behalf.

When can I trade Sygnia Itrix ETFs?

Sygnia Itrix ETFs trade on the JSE like any listed share. Continuous and tight bid/ask prices and liquidity are provided for the Sygnia Itrix ETFs by the market maker.

How do I invest in Sygnia Itrix ETFs?

Investing in Sygnia Itrix ETFs is easy. You can invest via your stockbroker, independent financial advisor or directly via the Sygnia Alchemy platform. Visit our FAQ page for more information.

How do I invest a monthly amount?

You will need to sign up on the Sygnia Alchemy platform, offered by Sygnia Financial Services, to set up a monthly debit order (minimum amount of R500 per month).

What is the cost of investing in Sygnia Itrix ETFs?

Fees and costs vary across the Sygnia Itrix ETF fund range. For a detailed breakdown of ETF-specific fees, please refer to the Sygnia Alchemy ETF and ETN Fund Summary.

What are the benefits of investing in Sygnia Itrix ETFs?

Sygnia Itrix ETFs are efficient, transparent, flexible and low cost.

Efficient

Continuous access: Sygnia Itrix ETFs trade during normal exchange trading hours on the JSE, just like shares.

Intraday pricing: A dedicated market maker provides continuous and competitive bid/ask prices for Sygnia Itrix ETFs.

Transparent

Portfolio visibility: The composition of the index being tracked by each Sygnia Itrix ETF is published daily on the Sygnia website.

Flexible

Trading size flexibility: Unlike other instruments, such as futures, Sygnia Itrix ETFs can be traded in small lot sizes. The unique structure of Sygnia Itrix ETFs also allows for ETFs to be traded in large sizes without impacting the market.

Multiple investment uses: Sygnia Itrix ETFs can be used by institutional investors for a variety of investment strategies ranging from an intraday trading tool to forming the basis of long-term asset allocation decisions.

Instant global access: Sygnia Itrix ETFs offer you exposure to international equity markets or regions in one transaction.

Easy to trade: Sygnia Itrix ETFs are traded just like shares and can be bought or sold by placing a simple order through your stockbroker or through selected LISPs.

Low cost

Low fees: Sygnia Itrix ETFs are passive index-tracking instruments with low annual management fees and total expense ratios (TERs). There are no additional or hidden costs. There are no fees for buying or selling other than those charged by your broker and the bid/offer spread associated with trading on an exchange.

Effective index tracking: Sygnia Itrix ETFs are designed to track their benchmark index as closely as is reasonably possible.

Why invest in Sygnia Itrix ETFs instead of buying shares in individually listed companies?

To track the performance of an index you would have to buy its constituent shares and then track and manage your portfolio accordingly. This would be both prohibitively expensive and time-consuming, and international indices are further constrained by exchange-control restrictions. Sygnia Itrix ETFs are a convenient and cost-effective way for investors to achieve exposure to a broad range of equities in local and international markets.

What is the difference between an ETF and a unit trust?

While both unit trusts and ETFs are regulated and registered under the Collective Investment Scheme Control Act, ETFs trade on stock exchanges like any other listed, tradable security. ETFs are traded intraday, during exchange trading hours, unlike unit trusts, which can only be traded at the end of the trading day.

What does tracking error mean?

The tracking error is a measure of the efficiency with which an ETF achieves its investment objective of tracking the underlying index. The lower the tracking error, the closer the performance of the ETF is to that of the underlying index.

What is an underlying index?

An underlying index is the index that a particular Sygnia Itrix ETF tracks. For example, the underlying index of the Sygnia Itrix MSCI USA Index ETF is the MSCI USA Index.

What is the investment objective of Sygnia Itrix ETFs?

The investment objective of each portfolio is to replicate the price and yield performance of the relevant indices they track and offer investors access to international investments (where applicable) through a regulated structure in an easy and cost-effective manner.

What are exchange traded funds (ETFs)?

ETFs are regulated, open-ended investment funds that trade on stock exchanges just like any other listed, tradable security. They combine the liquidity of stocks with the diversification offered by an index fund. Efficient, transparent and flexible, ETFs are the fastest-growing category of investment in the world today.

What are stockbroker fees?

This is a fee charged per transaction by the stockbroker who executes the transaction. For every transaction on the ETF, a stockbroker fee of 0.10% (excl. VAT) of the value of each transaction will be charged.

What is the total expense ratio (TER)?

This is the fee paid to the investment manager of the ETF and includes:

- Annual service fee

- Fund’s bank charges

- Fund’s audit fees

- Taxes (e.g. stamp duty, VAT)

- Custodian and trustee fees (custodians and trustees are appointed to protect the interests of the unitholders, and the fees pay for their services)

- Costs related to scrip lending

- Performance fees

What is the total investment charge (TIC)?

The total investment charge is the sum of the total expense ratio (TER) and the transaction cost (TC).

What are transaction costs (TC)?

These are the necessary expenses that arise from managing and administering an ETF and include:

- VAT

- Brokerage

- Securities transfer tax (STT)

- Investor protection levy

- STRATE contract fees

- Exchange rate costs

- Bond spread costs

- Fees associated with Contract for Difference (CFD)

What is an advisor fee?

This fee only applies if you have appointed a financial advisor and agreed upon a fee with them.

What are statutory charges?

There are two – the Investor Protection Levy and the STRATE Settlement Fee.

The Investor Protection Levy of 0.0002% (excl. VAT) is charged by the Johannesburg Stock Exchange (JSE) on all trades and protects investors against market manipulation and insider trading.

Every time you buy or sell a share, the transaction is settled electronically by a company named STRATE. Without this settlement, the transaction could not take place. For providing this service, STRATE charges an electronic settlement fee of 0.005787% (excl. VAT) of the value of each transaction.

What is a product fee?

The product fee is charged for using a retirement annuity, preservation fund or living annuity.

Sygnia does not charge product fees in respect of any of its savings products, irrespective of the nature of your investment, and no administration or transaction fees of any sort are applied to the provision of savings product wrappers.

Need help? We are here.

Call us

Call us on 010 595 0593 or 010 595 0555.

Monday – Friday, 8am – 5pm.

Send us a message

You can also send us an email at settlements@sec.sygnia.co.za, and we’ll strive to respond to your email within 24 business hours.